Top Financial Certifications Dumps 2026 List

-

CATEGORIESEXAM TRACKSEXAM QUESTION NUMBERDUMP COVERAGEPass Exam DUMPSFREE TEST

-

Financial Certifications200+100% cover

-

Financial Certifications200+100% cover

-

Financial Certifications200+100% cover

-

Financial Certifications200+100% cover

-

Financial Certifications200+100% cover

-

Financial Certifications200+100% cover

-

Financial Certifications200+100% cover

-

Financial Certifications200+100% cover

-

Financial Certifications200+100% cover

-

Financial Certifications200+100% cover

-

Luc***2026/02/24order ***Hen***2026/02/24order ***Ale***2026/02/24order ***

-

Mas***2026/02/24order ***Mic***2026/02/24order ***Eth***2026/02/24order ***

-

Dan***2026/02/24order ***Jac***2026/02/24order ***Log***2026/02/24order ***

-

Jac***2026/02/24order ***Lev***2026/02/24order ***Seb***2026/02/24order ***

-

Mat***2026/02/24order ***Jac***2026/02/24order ***Owe***2026/02/24order ***

-

The***2026/02/24order ***Aid***2026/02/24order ***Sam***2026/02/24order ***

-

Lia***2026/02/24order ***Noa***2026/02/24order ***Oli***2026/02/24order ***

-

Eli***2026/02/24order ***Wil***2026/02/24order ***Jam***2026/02/24order ***

-

Luc***2026/02/24order ***

-

Mas***2026/02/24order ***

-

Dan***2026/02/24order ***

-

Jac***2026/02/24order ***

-

Owe***2026/02/24order ***

-

The***2026/02/24order ***

-

Lia***2026/02/24order ***

-

Wil***2026/02/24order ***

Certified Financial Planner CFP Certification Overview

The Certified Financial Planner (CFP) designation is a formal acknowledgment of expertise encompassing financial planning, taxes, insurance, estate planning, and retirement saving. The CFP Certification Examinations are meticulously crafted to evaluate examinees' proficiency in applying financial planning knowledge to real-world scenarios, ensuring that CFP certificants possess the requisite level of competency essential for professional practice. Administered and granted by the Certified Financial Planner Board of Standards, Inc., the certification is upheld through continuous participation in annual education programs, facilitating the maintenance and enhancement of skills.

Recognized as the world's oldest and most prestigious advanced certification for financial planners, CFP Certification represents the pinnacle of excellence in financial planning. CFP professionals are held to rigorous standards of competence, ethics, and practice, both at the outset and throughout their careers. Operating across 26 countries and territories worldwide, individuals within the financial industry aspire to distinguish themselves with CFP Certification—a symbol of unparalleled professional distinction within the financial planning sector.

Certified Financial Planner Certification

CFP

170 questions

Multiple Choice,

Independent Questions and Scenario-Based Questions

Two 3-hour sessions

3

Principal Knowledge Domains And Topics:

1. Professional Conduct and Regulation (8%)2. General Principles of Financial Planning (15%)

3. Risk Management and Insurance Planning (11%)

4. Investment Planning (17%)

5. Tax Planning (14%)

6. Retirement Savings and Income Planning (18%)

7. Estate Planning (10%)

8. Psychology of Financial Planning (7%)

The Certified Financial Planner (CFP) designation is a formal acknowledgment of expertise encompassing financial planning, taxes, insurance, estate planning, and retirement saving. The CFP Certification Examinations are meticulously crafted to evaluate examinees' proficiency in applying financial planning knowledge to real-world scenarios, ensuring that CFP certificants possess the requisite level of competency essential for professional practice. Administered and granted by the Certified Financial Planner Board of Standards, Inc., the certification is upheld through continuous participation in annual education programs, facilitating the maintenance and enhancement of skills.

Recognized as the world's oldest and most prestigious advanced certification for financial planners, CFP Certification represents the pinnacle of excellence in financial planning. CFP professionals are held to rigorous standards of competence, ethics, and practice, both at the outset and throughout their careers. Operating across 26 countries and territories worldwide, individuals within the financial industry aspire to distinguish themselves with CFP Certification—a symbol of unparalleled professional distinction within the financial planning sector.

Certified Financial Planner Certification

CFP

170 questions

Multiple Choice,

Independent Questions and Scenario-Based Questions

Two 3-hour sessions

3

Principal Knowledge Domains And Topics:

1. Professional Conduct and Regulation (8%)2. General Principles of Financial Planning (15%)

3. Risk Management and Insurance Planning (11%)

4. Investment Planning (17%)

5. Tax Planning (14%)

6. Retirement Savings and Income Planning (18%)

7. Estate Planning (10%)

8. Psychology of Financial Planning (7%)

Certified Financial Planner CFP Exam FAQ

1.What is Certified Financial Planner CFP dumps and exam questions?

SPOTO expert team has prepared CFP dumps for the exam, which covers real exam questions and answers, sample questions. All exam questions and answers are from the latest version of the exam and will have been reviewed multiple times by a team of experts. Candidates can use practice exams to evaluate your preparation for the Certified Financial Planner CFP exam and familiarize yourself with the exam difficulty in advance. In this practice simulation exercise of CFP dumps, you will learn what types of questions will be asked on the exam and the difficulty level at which you can be tested. Certified Financial Planner dumps are the best exam preparation resources that will help you successfully pass the exam within a week.

2.Why choose SPOTO Certified Financial Planner CFP practice questions?

1. Comprehensive questions - SPOTO's question bank may cover all the key concepts tested on the actual CFP exam across the major financial planning topics like insurance, investment, tax, retirement, estate planning, etc.

2. Similar difficulty level - The SPOTO CFP questions are likely designed to mimic the difficulty level and format of the real exam to help prepare test takers.

3. Detailed explanations - Quality practice questions often provide detailed answer explanations to help reinforce knowledge and understand why an answer is correct or not.

4. Up-to-date content - SPOTO probably keeps their practice questions updated in line with the latest CFP exam content and regulatory requirements.

5. Convenient online access - Being able to access CFP practice questions online provides flexibility to study anytime, anywhere.

High-quality Certified Financial Planner CFP practice questions can help candidates successfully pass the certification exam on the first try. SPOTO has helped tens of thousands of candidates successfully pass different certification exams. Providing high-quality learning materials is SPOTO's original intention. You can definitely trust SPOTO!

3.How to Become a Certified Financial Planner CFP?

Achieving the Certified Financial Planner (CFP) designation involves fulfilling criteria across four key areas: formal education, performance on the CFP exam, relevant work experience, and the demonstration of professional ethics.

The educational prerequisites encompass two primary elements. First, candidates must possess a bachelor's degree or higher from an accredited university or college. Second, they are required to successfully complete a set of specific courses in financial planning as outlined by the CFP Board. In terms of professional experience, candidates must substantiate a minimum of three years (or 6,000 hours) of full-time professional engagement in the industry, or two years (4,000 hours) in an apprenticeship role.

Adherence to the CFP Board's standards of professional conduct is imperative for both candidates and existing CFP holders. Regular disclosure of information related to criminal activity, government inquiries, bankruptcies, customer complaints, or terminations by employers is mandatory. Prior to certification, the CFP Board conducts a thorough background check on all candidates. It's important to note that successful completion of these requirements does not guarantee the conferral of the CFP designation, as the CFP Board retains final discretion in granting the certification to individuals.

4.What type of questions are on the CFP exam?

The CFP® exam is comprised of 170 multiple-choice questions that assess proficiency in the Principal Knowledge Topics. The questions encompass three distinct types:

1. Stand-alone questions: These are individual questions that evaluate your understanding of specific topics without being connected to broader scenarios.

2. Short scenarios: In this question type, you will be presented with brief situations or contexts that require you to apply your knowledge to make informed decisions.

3. Case studies: These questions involve more extensive scenarios, requiring a comprehensive understanding of financial planning principles to analyze and respond effectively.

By encompassing these three question types, the CFP® exam aims to comprehensively evaluate candidates' knowledge, application skills, and ability to handle complex financial planning scenarios.

5.Certified Financial Planner CFP exam domains and topics

The CFP® Certification Examination evaluates your capacity to integrate and apply a comprehensive range of financial planning knowledge within the context of real-life financial planning scenarios. Emphasizing critical thinking and problem-solving skills, the exam places less weight on factual recall or recognition.

Volunteer subject matter experts craft exam questions based on the results of a practice analysis of personal financial planning. This analysis delineates the Principal Knowledge Domains, forming the foundation for developing exam content. Each of the 170 exam questions is associated with at least one Principal Knowledge Topic, aligning with specific areas of expertise.

Fast-Pass CFP Exam Service within 7 Days

A recent survey also showed that many IT professionals experienced a 20% salary raise after getting certified. So if you want to get certified and seldom get time to prepare for it, our SPOTO can help you to pass the exam on the first try. We will ensure your IT certification experience goes as smoothly as possible. You don't need to take training, do long preparation, or learn. We will handle everything for you!

Latest Passing Reports from SPOTO Candidates

RELATED Practice test

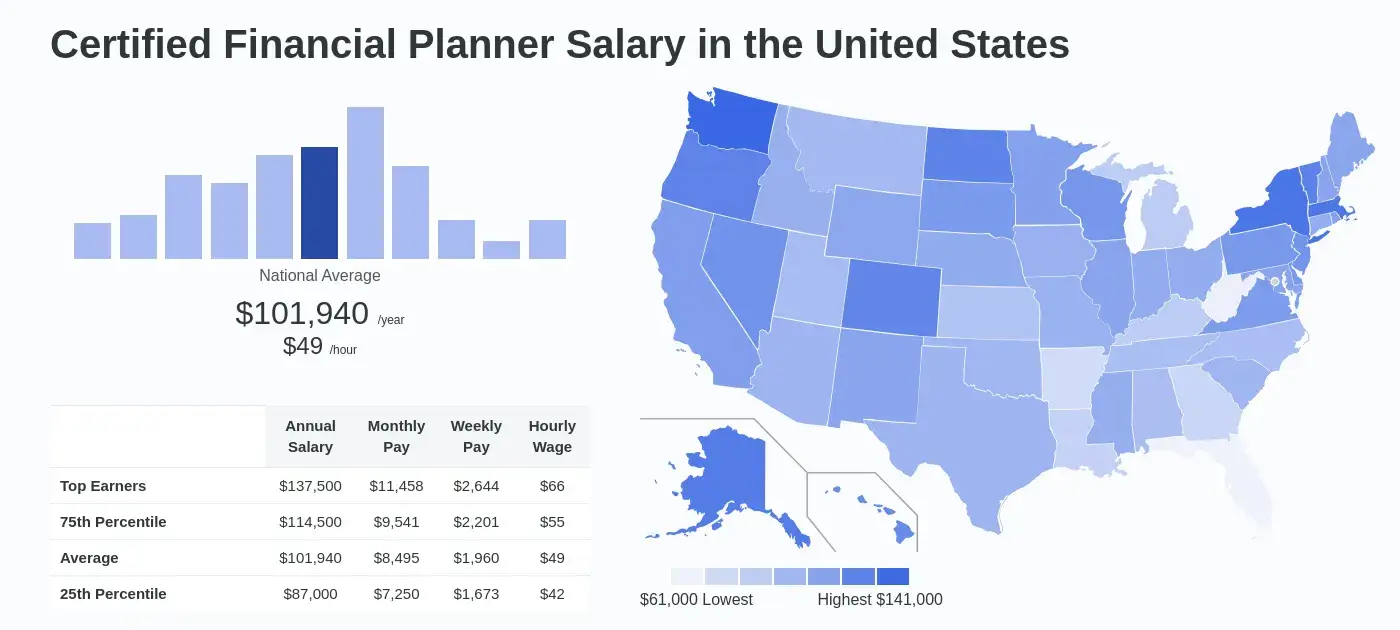

How Much Can You Make with the Certification?

Certified professionals can earn up to 40-percent more than their non-certified peers.

About SPOTO CFP practice exam FAQ

1.How do SPOTO CFP practice questions compare to other study materials?

Different from free exam questions, SPOTO provides 100% real exam questions and answers, and all exam questions are up to date. All you need to do is memorize the exam questions and answers to successfully pass the exam.

2.Can I pass the exam without preparing?

SPOTO provides practice tests that cover 100% of the exam questions, you need to practice the exam questions within 1 weeks and memorize the exam questions. You can easily pass the exam.

3.Can I get special offers?

You need to communicate with sales and obtain discounts, SPOTO will provide product discounts at a specific time. If you purchase multiple exams, you will receive a discount.

4.How many questions are there in SPOTO's practice exam?

The number of SPOTO practice exam questions is relative to the actual exam. In order to cover all the exam questions 100%, we will provide exercises that are higher than the number of exam questions. usually, the number of exam questions is between 200- 300 questions.