Top Financial Certifications Dumps 2026 List

-

CATEGORIESEXAM TRACKSEXAM QUESTION NUMBERDUMP COVERAGEPass Exam DUMPSFREE TEST

-

Financial Certifications200+100% cover

-

Financial Certifications200+100% cover

-

Financial Certifications200+100% cover

-

Financial Certifications200+100% cover

-

Financial Certifications200+100% cover

-

Financial Certifications200+100% cover

-

Financial Certifications200+100% cover

-

Financial Certifications200+100% cover

-

Financial Certifications200+100% cover

-

Financial Certifications200+100% cover

-

Luc***2026/02/19order ***Hen***2026/02/19order ***Ale***2026/02/19order ***

-

Mas***2026/02/19order ***Mic***2026/02/19order ***Eth***2026/02/19order ***

-

Dan***2026/02/19order ***Jac***2026/02/19order ***Log***2026/02/19order ***

-

Jac***2026/02/19order ***Lev***2026/02/19order ***Seb***2026/02/19order ***

-

Mat***2026/02/19order ***Jac***2026/02/19order ***Owe***2026/02/19order ***

-

The***2026/02/19order ***Aid***2026/02/19order ***Sam***2026/02/19order ***

-

Lia***2026/02/19order ***Noa***2026/02/19order ***Oli***2026/02/19order ***

-

Eli***2026/02/19order ***Wil***2026/02/19order ***Jam***2026/02/19order ***

-

Luc***2026/02/19order ***

-

Mas***2026/02/19order ***

-

Dan***2026/02/19order ***

-

Jac***2026/02/19order ***

-

Owe***2026/02/19order ***

-

The***2026/02/19order ***

-

Lia***2026/02/19order ***

-

Wil***2026/02/19order ***

Accredited Investment Fiduciary AIF Certification Overview

The Accredited Investment Fiduciary® (AIF®) Designation is a distinguished professional certification signifying that an advisor or individual serving as an investment fiduciary has fulfilled specific requirements to attain and uphold this credential. The primary objective of the AIF Designation is to ensure that those entrusted with managing or advising on investor assets possess a foundational comprehension of fiduciary duty principles, the ethical standards governing fiduciary conduct, and a systematic approach to fulfilling fiduciary responsibilities.

To attain the AIF® designation, candidates must undergo a comprehensive training program, successfully pass a rigorous, closed-book final examination administered under the supervision of a proctor, and commit to adhering to the AIF® Code of Ethics. Sustaining the AIF® designation mandates an annual reaffirmation of adherence to the AIF Code of Ethics and the completion of six hours of continuing education credits.

Accredited Investment Fiduciary AIF

80 questions

$1,950

closed book

120 minutes

70%

Accredited Investment Fiduciary AIF Exam Blueprint:

1. Organize. Fiduciary Roles and Responsibilities Are Clearly Documented and Defined2. Formalize. The Investment Policy is Consistent with Objectives for the Portfolio and Risk and Return Assumptions

3. Implement. Decisions Regarding Investments and Services are Implemented in Accordance with the Duties of Loyalty and Care

4. Monitor. The Portfolio is Monitored Regularly to Ensure Consistency with Benchmarks and Overall Objectives

The Accredited Investment Fiduciary® (AIF®) Designation is a distinguished professional certification signifying that an advisor or individual serving as an investment fiduciary has fulfilled specific requirements to attain and uphold this credential. The primary objective of the AIF Designation is to ensure that those entrusted with managing or advising on investor assets possess a foundational comprehension of fiduciary duty principles, the ethical standards governing fiduciary conduct, and a systematic approach to fulfilling fiduciary responsibilities.

To attain the AIF® designation, candidates must undergo a comprehensive training program, successfully pass a rigorous, closed-book final examination administered under the supervision of a proctor, and commit to adhering to the AIF® Code of Ethics. Sustaining the AIF® designation mandates an annual reaffirmation of adherence to the AIF Code of Ethics and the completion of six hours of continuing education credits.

Accredited Investment Fiduciary AIF

80 questions

$1,950

closed book

120 minutes

70%

Accredited Investment Fiduciary AIF Exam Blueprint:

1. Organize. Fiduciary Roles and Responsibilities Are Clearly Documented and Defined2. Formalize. The Investment Policy is Consistent with Objectives for the Portfolio and Risk and Return Assumptions

3. Implement. Decisions Regarding Investments and Services are Implemented in Accordance with the Duties of Loyalty and Care

4. Monitor. The Portfolio is Monitored Regularly to Ensure Consistency with Benchmarks and Overall Objectives

Accredited Investment Fiduciary AIF Exam FAQ

1.What is Accredited Investment Fiduciary AIF dumps and practice questions?

SPOTO expert team has prepared AIF dumps for candidates, which covers real exam questions and answers, sample questions. All exam questions and answers are from the latest version of the exam and will have been reviewed multiple times by a team of experts. Candidates can use practice exams to evaluate your preparation for the Accredited Investment Fiduciary exam and familiarize yourself with the exam difficulty in advance. In this practice simulation exercise of AIF dumps, you will learn what types of questions will be asked on the exam and the difficulty level at which you can be tested. Accredited Investment Fiduciary AIF practice tests are the best exam preparation resources that will help you successfully pass the exam within a week.

2.Accredited Investment Fiduciary (AIF) Exam Requirements

To obtain the AIF® designation, candidates must successfully complete a comprehensive training program, pass a rigorous closed-book final examination conducted under the supervision of a proctor, and commit to adhering to the AIF® Code of Ethics. Maintaining the AIF® designation necessitates an annual renewal of affirmation to the AIF Code of Ethics and the completion of six hours of continuing education credits.

The certification is administered by the Center for Fiduciary Studies, LLC, a subsidiary of Fiduciary360 (fi360) company, emphasizing the reputable oversight and rigorous standards associated with the accreditation process.

3.What are the advantages of SPOTO AIF dumps questions?

1. The questions precisely reflect the real exam material and format so you can become accustomed to the actual test. SPOTO models their practice questions on genuine exam content to simulate the real testing experience.

2. The answers provided are completely accurate and verified by SPOTO's team of experts, not just the questions themselves. Detailed explanations help cement comprehension of the concepts rather than just promoting memorization.

3. Identifying weaknesses is easy with SPOTO. By showing which areas or question types give you difficulty, SPOTO questions enable you to pinpoint gaps in your knowledge and use study time more effectively.

4. Exam question updates match any real test changes by SPOTO, keeping your preparation current.

5. Accessible 24/7 online, you can self-pace with SPOTO practice tests conveniently. The flexibility allows you to study anytime, anywhere.

Fast-Pass AIF Exam Service within 7 Days

A recent survey also showed that many IT professionals experienced a 20% salary raise after getting certified. So if you want to get certified and seldom get time to prepare for it, our SPOTO can help you to pass the exam on the first try. We will ensure your IT certification experience goes as smoothly as possible. You don't need to take training, do long preparation, or learn. We will handle everything for you!

Latest Passing Reports from SPOTO Candidates

RELATED Practice test

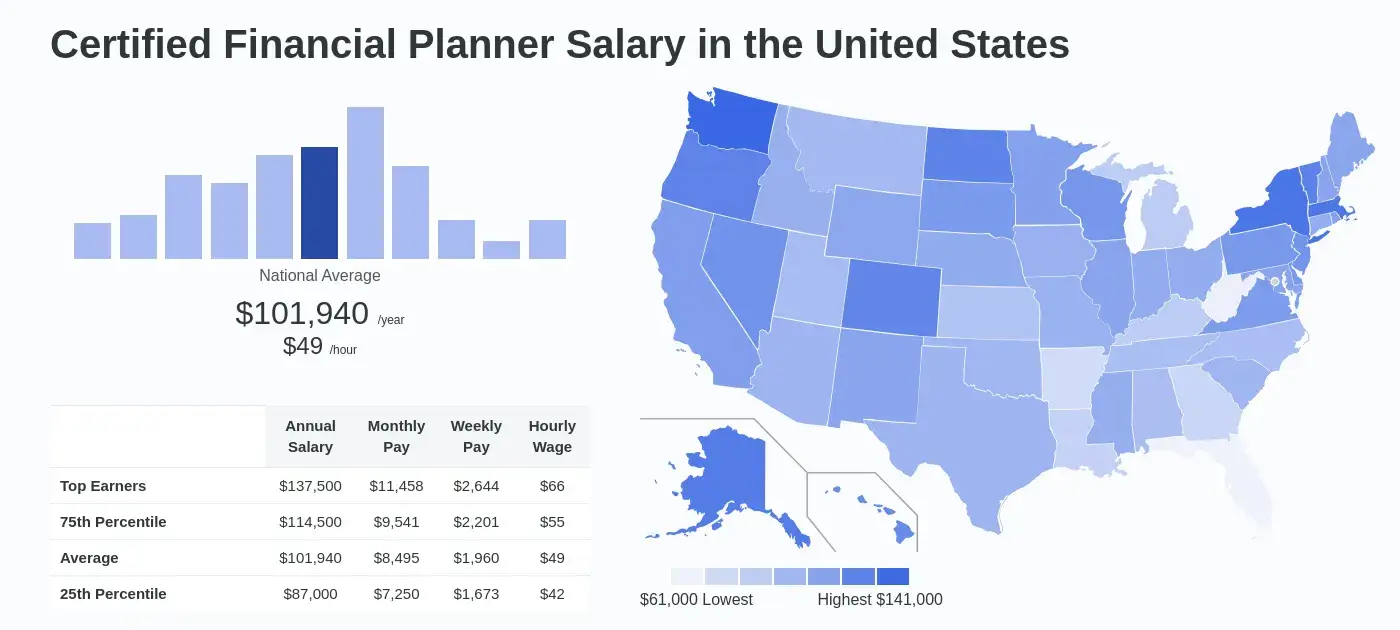

How Much Can You Make with the Certification?

Certified professionals can earn up to 40-percent more than their non-certified peers.

About SPOTO AIF practice questions FAQ

1.How can I find reliable and up-to-date AIF exam dumps?

SPOTO is a professional exam dumps provider, we have helped tens of thousands of candidates pass the exam successfully. You can definitely trust SPOTO!

2.How can I contact you with any questions or concerns?

After purchasing SPOTO's test service, we have a dedicated tutor to serve you 24 hours a day. You can ask her any exam-related questions.

3.Does use the AIF practice exam guarantee passing exam?

SPOTO provides 100% real AIF exam questions and answers and is the best practice for exam preparation. You just need to memorize the exam questions and answers to pass the exam successfully.

4.Are AIF practice tests updated frequently?

Yes, SPOTO's product managers will update the AIF exam questions regularly. We guarantee the delivery of up-to-date and valid exam questions.