Top Financial Certifications Dumps 2026 List

-

CATEGORIESEXAM TRACKSEXAM QUESTION NUMBERDUMP COVERAGEPass Exam DUMPSFREE TEST

-

Financial Certifications200+100% cover

-

Financial Certifications200+100% cover

-

Financial Certifications200+100% cover

-

Financial Certifications200+100% cover

-

Financial Certifications200+100% cover

-

Financial Certifications200+100% cover

-

Financial Certifications200+100% cover

-

Financial Certifications200+100% cover

-

Financial Certifications200+100% cover

-

Financial Certifications200+100% cover

-

Luc***2026/02/22order ***Hen***2026/02/22order ***Ale***2026/02/22order ***

-

Mas***2026/02/22order ***Mic***2026/02/22order ***Eth***2026/02/22order ***

-

Dan***2026/02/22order ***Jac***2026/02/22order ***Log***2026/02/22order ***

-

Jac***2026/02/22order ***Lev***2026/02/22order ***Seb***2026/02/22order ***

-

Mat***2026/02/22order ***Jac***2026/02/22order ***Owe***2026/02/22order ***

-

The***2026/02/22order ***Aid***2026/02/22order ***Sam***2026/02/22order ***

-

Lia***2026/02/22order ***Noa***2026/02/22order ***Oli***2026/02/22order ***

-

Eli***2026/02/22order ***Wil***2026/02/22order ***Jam***2026/02/22order ***

-

Luc***2026/02/22order ***

-

Mas***2026/02/22order ***

-

Dan***2026/02/22order ***

-

Jac***2026/02/22order ***

-

Owe***2026/02/22order ***

-

The***2026/02/22order ***

-

Lia***2026/02/22order ***

-

Wil***2026/02/22order ***

Certified Public Accountant (CPA) Certification Overview

Elevate your career in accounting and finance with the prestigious Certified Public Accountant (CPA) Certification. Recognized globally as the gold standard in professional accounting qualifications, the CPA designation demonstrates a commitment to excellence, integrity, and advanced knowledge in accounting principles, financial reporting, taxation, and business regulations.

Expertise in Financial Management: Acquire in-depth knowledge and skills in financial management, enabling you to analyze complex financial data, develop strategic financial plans, and provide valuable insights to organizations.

Comprehensive Taxation Knowledge: Stay at the forefront of taxation regulations and practices, ensuring your ability to navigate intricate tax codes, optimize financial strategies, and advise clients or employers on tax-related matters.

Ethical Leadership: The CPA Certification emphasizes the importance of ethical behavior and professional conduct. As a CPA, you are committed to upholding the highest ethical standards, fostering trust, and maintaining integrity in all financial activities.

Global Recognition: With international recognition, the CPA designation opens doors to global career opportunities. Employers and clients alike value the rigorous education and experience required to earn and maintain CPA status.

Career Advancement: Differentiate yourself in the competitive field of accounting and finance. The CPA Certification not only enhances your professional credibility but also opens doors to leadership positions, higher salaries, and increased job prospects.

Continual Professional Development: Stay ahead in your field with ongoing professional development. The CPA Certification requires continued learning and adherence to the latest industry standards, ensuring that you remain a trusted expert in your field.

Whether you aspire to work in public accounting, corporate finance, government, or consulting, the CPA Certification equips you with the knowledge and skills needed to excel in a dynamic and evolving financial landscape. Invest in your professional future by becoming a Certified Public Accountant – a mark of excellence in the world of finance.

Certified Public Accountant (CPA) Examination

300-400 questions

AUD, FAR, BEC, ETH

3 to 4 hours per section

multiple-choice questions, task-based simulations, and written communication tasks

50%

Exam Prerequisites:

1.Education: Bachelor's degree from an accredited institution. Completion of required accounting and business coursework. 2. Credit Hours: Completion of specified credit hours in relevant courses. 3. Work Experience: Some jurisdictions may require supervised work experience in accounting. 4. Registration: Registration with the state board of accountancy or relevant regulatory authority. 5. Ethics Exam: Successful completion of an ethics exam or ethics declaration.

Elevate your career in accounting and finance with the prestigious Certified Public Accountant (CPA) Certification. Recognized globally as the gold standard in professional accounting qualifications, the CPA designation demonstrates a commitment to excellence, integrity, and advanced knowledge in accounting principles, financial reporting, taxation, and business regulations.

Expertise in Financial Management: Acquire in-depth knowledge and skills in financial management, enabling you to analyze complex financial data, develop strategic financial plans, and provide valuable insights to organizations.

Comprehensive Taxation Knowledge: Stay at the forefront of taxation regulations and practices, ensuring your ability to navigate intricate tax codes, optimize financial strategies, and advise clients or employers on tax-related matters.

Ethical Leadership: The CPA Certification emphasizes the importance of ethical behavior and professional conduct. As a CPA, you are committed to upholding the highest ethical standards, fostering trust, and maintaining integrity in all financial activities.

Global Recognition: With international recognition, the CPA designation opens doors to global career opportunities. Employers and clients alike value the rigorous education and experience required to earn and maintain CPA status.

Career Advancement: Differentiate yourself in the competitive field of accounting and finance. The CPA Certification not only enhances your professional credibility but also opens doors to leadership positions, higher salaries, and increased job prospects.

Continual Professional Development: Stay ahead in your field with ongoing professional development. The CPA Certification requires continued learning and adherence to the latest industry standards, ensuring that you remain a trusted expert in your field.

Whether you aspire to work in public accounting, corporate finance, government, or consulting, the CPA Certification equips you with the knowledge and skills needed to excel in a dynamic and evolving financial landscape. Invest in your professional future by becoming a Certified Public Accountant – a mark of excellence in the world of finance.

Certified Public Accountant (CPA) Examination

300-400 questions

AUD, FAR, BEC, ETH

3 to 4 hours per section

multiple-choice questions, task-based simulations, and written communication tasks

50%

Exam Prerequisites:

1.Education: Bachelor's degree from an accredited institution. Completion of required accounting and business coursework. 2. Credit Hours: Completion of specified credit hours in relevant courses. 3. Work Experience: Some jurisdictions may require supervised work experience in accounting. 4. Registration: Registration with the state board of accountancy or relevant regulatory authority. 5. Ethics Exam: Successful completion of an ethics exam or ethics declaration.Certified Public Accountant CPA Certification FAQ

1.Does SPOTO CPA exam dumps include CPA study material?

No, SPOTO CPA exam dumps do not include CPA study material. However, the dumps cover all exam topics and points. Through exam practice with these dumps, you can effectively master the test points, significantly improving your CPA passing rate. The focus is on practical application and reinforcement of knowledge acquired through traditional study materials.

Accelerate Success: CPA Exam Conquered Swiftly with SPOTO!

Unlock success with SPOTO's elite team of professionals. Our meticulously curated CPA exam dumps guarantee accuracy and reliability. Shorten your study time and elevate your passing rate with SPOTO's proven expertise. Your pathway to CPA excellence starts here!

Latest Passing Reports from SPOTO Candidates

RELATED Practice test

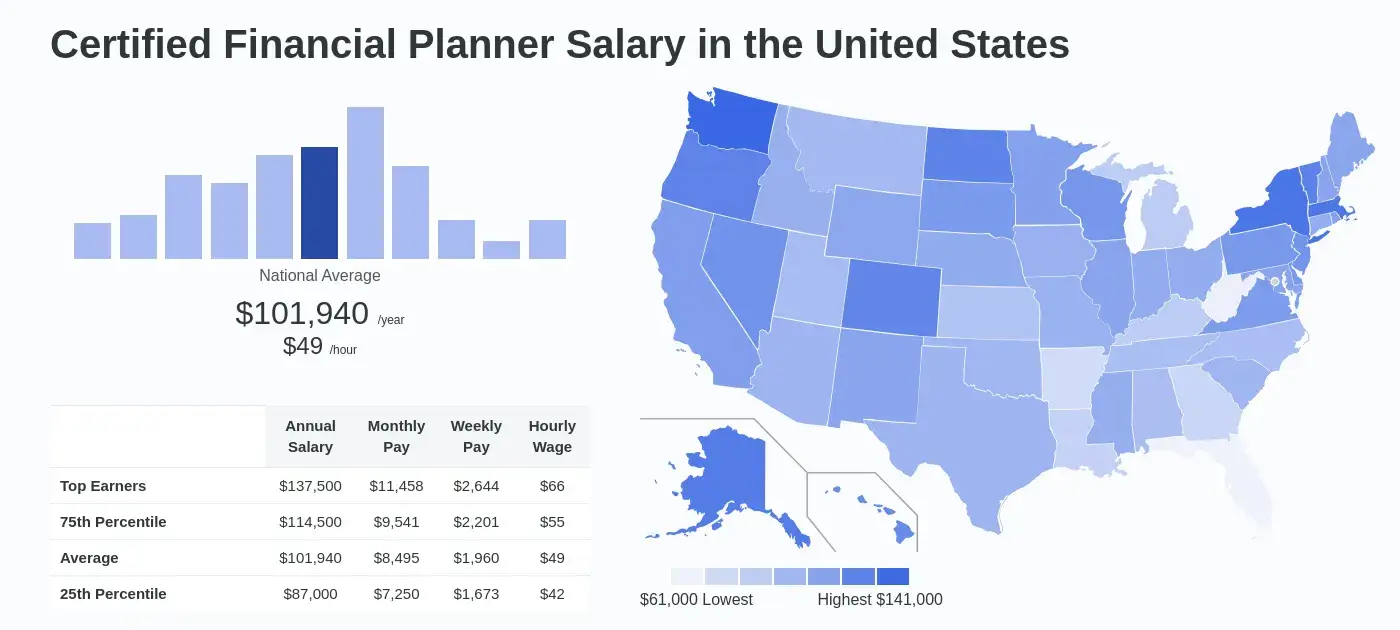

How Much Can You Make with the Certification?

Certified professionals can earn up to 40-percent more than their non-certified peers.

About SPOTO CPA practice exam FAQ

1.How do I practice my CPA dumps questions?

After purchasing SPOTO's exam dumps, the sales will send the SPOTO online practice address, login account, and password to your email. You can log in for the first time and take part in the practice test.

2.Can I get special offers?

You need to communicate with sales and obtain discounts, SPOTO will provide product discounts at a specific time. If you purchase multiple exams, you will receive a discount.

3.How do SPOTO CPA practice questions compare to other study materials?

Different from free exam questions, SPOTO provides 100% real exam questions and answers, and all exam questions are up to date. All you need to do is memorize the exam questions and answers to successfully pass the exam.

4.Does use the CPA practice exam guarantee passing exam?

SPOTO provides 100% real CPA exam questions and answers and is the best practice for exam preparation. You just need to memorize the exam questions and answers to pass the exam successfully.