Top Financial Certifications Dumps 2026 List

-

CATEGORIESEXAM TRACKSEXAM QUESTION NUMBERDUMP COVERAGEPass Exam DUMPSFREE TEST

-

Financial Certifications200+100% cover

-

Financial Certifications200+100% cover

-

Financial Certifications200+100% cover

-

Financial Certifications200+100% cover

-

Financial Certifications200+100% cover

-

Financial Certifications200+100% cover

-

Financial Certifications200+100% cover

-

Financial Certifications200+100% cover

-

Financial Certifications200+100% cover

-

Financial Certifications200+100% cover

-

Luc***2026/02/18order ***Hen***2026/02/18order ***Ale***2026/02/18order ***

-

Mas***2026/02/18order ***Mic***2026/02/18order ***Eth***2026/02/18order ***

-

Dan***2026/02/18order ***Jac***2026/02/18order ***Log***2026/02/18order ***

-

Jac***2026/02/18order ***Lev***2026/02/18order ***Seb***2026/02/18order ***

-

Mat***2026/02/18order ***Jac***2026/02/18order ***Owe***2026/02/18order ***

-

The***2026/02/18order ***Aid***2026/02/18order ***Sam***2026/02/18order ***

-

Lia***2026/02/18order ***Noa***2026/02/18order ***Oli***2026/02/18order ***

-

Eli***2026/02/18order ***Wil***2026/02/18order ***Jam***2026/02/18order ***

-

Luc***2026/02/18order ***

-

Mas***2026/02/18order ***

-

Dan***2026/02/18order ***

-

Jac***2026/02/18order ***

-

Owe***2026/02/18order ***

-

The***2026/02/18order ***

-

Lia***2026/02/18order ***

-

Wil***2026/02/18order ***

Financial Risk Manager FRM Exam Overview

The acronym FRM stands for Financial Risk Manager, and it is a certification offered by the Global Association of Risk Professionals (GARP). Widely regarded as the premier certification for risk managers, the FRM designation is highly sought after due to its recognition of individuals with the ability to anticipate, respond, and adapt to critical risk issues. Possessing the FRM designation signals to banks and financial firms that an individual takes risk management seriously, and their knowledge has been validated against international professional standards.

To attain the FRM certification, candidates must successfully complete both Part I and Part II of the FRM Exam. While there are no specific education or work requirements for taking the exam, individuals must demonstrate at least two years of full-time work experience in the field of risk after passing both exam parts. Acceptable work experience is limited to finance-related vocations, such as portfolio management, industry research, trading, and risk consulting.

FRM

Part I:100 multiple-choice questions

Part II:80 multiple-choice questions

multiple-choice questions

May, August, and November

four hours/each exam

Early registration fee: $600

Standard registration fee: $800

Pass rate for the FRM® exam:

In 2023, the pass rate for Part I is 45% and the pass rate for Part II is 63%. FRM practice exam is the best preparation material for exam preparation and it is the best supplement to training courses. It covers all the real questions and answers of Financial Risk Manager FRM exam and it will help you pass the exam successfully.

The acronym FRM stands for Financial Risk Manager, and it is a certification offered by the Global Association of Risk Professionals (GARP). Widely regarded as the premier certification for risk managers, the FRM designation is highly sought after due to its recognition of individuals with the ability to anticipate, respond, and adapt to critical risk issues. Possessing the FRM designation signals to banks and financial firms that an individual takes risk management seriously, and their knowledge has been validated against international professional standards.

To attain the FRM certification, candidates must successfully complete both Part I and Part II of the FRM Exam. While there are no specific education or work requirements for taking the exam, individuals must demonstrate at least two years of full-time work experience in the field of risk after passing both exam parts. Acceptable work experience is limited to finance-related vocations, such as portfolio management, industry research, trading, and risk consulting.

FRM

Part I:100 multiple-choice questions

Part II:80 multiple-choice questions

multiple-choice questions

May, August, and November

four hours/each exam

Early registration fee: $600

Standard registration fee: $800

Pass rate for the FRM® exam:

In 2023, the pass rate for Part I is 45% and the pass rate for Part II is 63%. FRM practice exam is the best preparation material for exam preparation and it is the best supplement to training courses. It covers all the real questions and answers of Financial Risk Manager FRM exam and it will help you pass the exam successfully.Financial Risk Manager FRM Exam FAQ

1.What is Financial Risk Manager FRM practice exam questions?

SPOTO expert team has prepared FRM practice exam for the exam, which covers real exam questions and answers, sample questions. All exam questions and answers are from the latest version of the exam and will have been reviewed multiple times by a team of experts. Candidates can use practice exams to evaluate your preparation for the FRM exam and familiarize yourself with the exam difficulty in advance. In this practice simulation exercise of Financial Risk Manager FRM practice exam, you will learn what types of questions will be asked on the exam and the difficulty level at which you can be tested. Financial Risk Manager FRM practice exam are the best exam preparation resources that will help you successfully pass the exam within a week.

2.What are the advantages of SPOTO FRM practice exam?

1. Be consistent with exam content and format. The SPOTO FRM practice exam is designed to be consistent with the real exam. Our product managers will regularly update exam questions, and all exam questions are derived from the latest version of the exam.

2. Detailed explanation of correct and incorrect answers. The SPOTO FRM practice exam provides detailed explanations to help you understand why the answers are correct or incorrect.

3. Identify weak links. Correcting the questions on the practice tests can allow you to pinpoint the topics or types of questions that you need to focus on. Improve the effectiveness of your exam preparation.

4. Be familiar with the exam format. Practicing through the FRM practice exam can help you become familiar with the exam format and difficulty, and you will be more familiar with the exam process.

5. Build confidence. Successfully answering SPOTO questions that are similar to real exam questions can boost your confidence when taking the actual exam.

3.What topics are covered in the FRM exam?

Part I of the FRM exam assesses your proficiency in the tools utilized for risk management.

FRM Part I Topics and Weights

Foundations of risk management (20%)

Quantitative analysis (20%)

Financial markets and products (30%)

Valuation and risk models (30%)

FRM Part II Topics and Weights

Part II of the FRM Exam, the focus shifts to the practical application of the tools tested in Part I.

Market risk measurement and management (20%)

Operational risk and resiliency (20%)

Credit risk measurement and management (20%)

Liquidity and treasury risk measurement and management (15%)

Risk management and investment management (15%)

Current issues in financial markets (10%)

4.What is the difference between FRM EXAM PART I and PART II?

The FRM Exam process follows a sequential structure, candidates must pass Exam Part I before their Exam Part II will be graded.

FRM EXAM PART I:

The FRM Exam Part I is a 100-question multiple-choice examination that focuses on the tools utilized in assessing financial risk. It encompasses the following key areas: foundations of risk management, quantitative analysis, financial markets and products, and valuation and risk models.

FRM EXAM PART II:

The FRM Exam Part II is an 80-question multiple-choice examination that emphasizes the practical application of the tools acquired in Part I. This includes a focus on market risk, credit risk, operational risk and resiliency, treasury and liquidity risk management, risk management and investment management, and current issues in financial markets.

Fast-Pass FRM Exam Service within 7 Days

A recent survey also showed that many IT professionals experienced a 20% salary raise after getting certified. So if you want to get certified and seldom get time to prepare for it, our SPOTO can help you to pass the exam on the first try. We will ensure your IT certification experience goes as smoothly as possible. You don't need to take training, do long preparation, or learn. We will handle everything for you!

Latest Passing Reports from SPOTO Candidates

RELATED Practice test

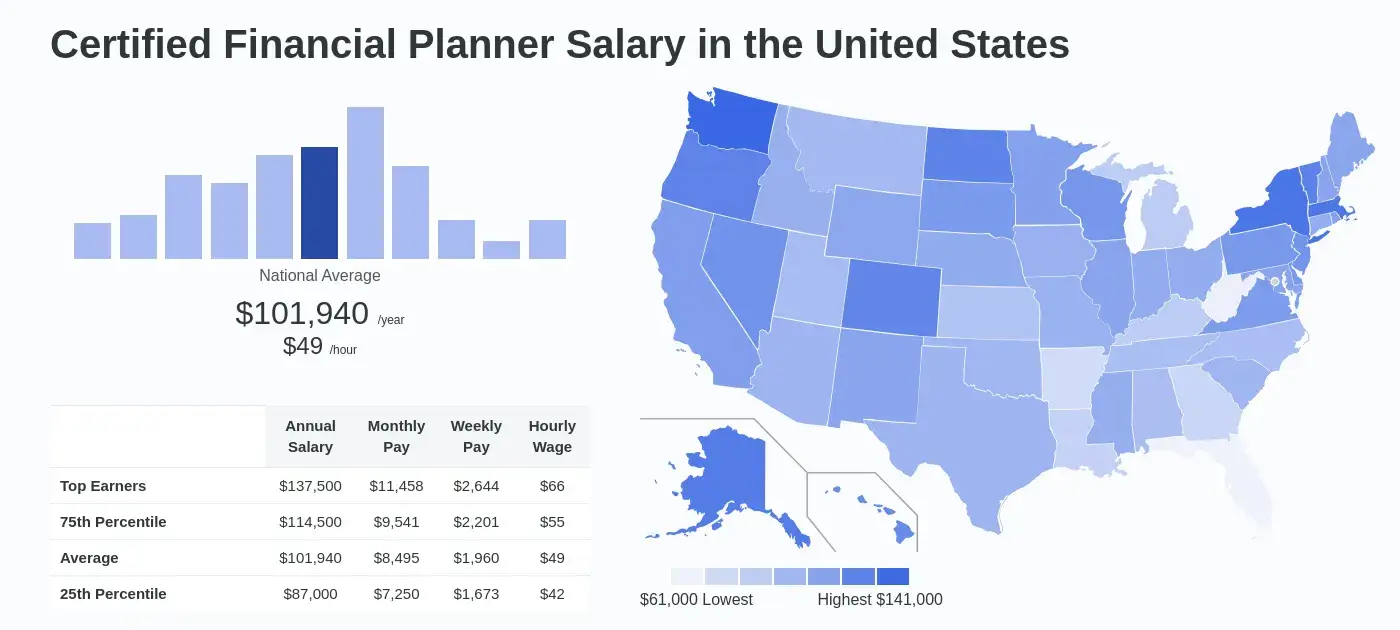

How Much Can You Make with the Certification?

Certified professionals can earn up to 40-percent more than their non-certified peers.

About SPOTO FRM practice questions FAQ

1.Can SPOTO FRM practice questions help prepare for the exam?

SPOTO FRM practice questions are the best supplement to training courses, after completing training courses you can improve your exam preparation by practicing exam questions. All exam questions from SPOTO dumps are real and up-to-date.

2.What are my options for paying for products?

Currently, SPOTO supports two payment methods: PayPal and credit cards. If you are having difficulty paying, please communicate with your advisor and resolve the issue.

3.How do SPOTO FRM practice exam compare to other study materials?

Different from free exam materials, SPOTO's exam questions are all up-to-date. SPOTO's product manager changes the exam questions according to exam updates. All exam questions are reviewed multiple times by experts and detailed exam answers are listed. All you need to do is practice multiple times and memorize the exam answers to successfully pass the exam.

4.Are FRM practice tests updated frequently?

Yes, SPOTO's product managers will update the FRM exam questions regularly. We guarantee the delivery of up-to-date and valid exam questions.