Table of Contents

Are you considering taking the CFA ESG exam? Whether you're already familiar with Environmental, Social, and Governance (ESG) investing or just starting to explore this area, it's important to understand the exam overview before you begin your preparation. In this blog, we'll provide an in-depth look at the CFA ESG exam, including its content, format, duration, passing score, study period, and more. By the end of this post, you'll have a clear understanding of what to expect from the exam and how to best prepare for it.

Exam Overview

Content: The CFA ESG exam covers the basic knowledge and practical application of ESG investing. This includes understanding environmental factors such as climate change and resource scarcity, social factors such as labor standards and community relations, and governance factors such as corporate board structure and executive compensation. Candidates are expected to demonstrate their ability to integrate ESG considerations into investment analysis and decision-making processes.

Format: The exam can be taken online or at a test center, providing flexibility for candidates to choose the most convenient option for them.

Duration: The exam has a total duration of 2 hours and 20 minutes.

Questions: There are 100 single-selection questions, each with three choices.

Passing Score: Candidates are required to achieve a 60%-70% accuracy rate to pass the exam.

Average Pass Rate: The average pass rate for the CFA ESG exam is approximately 81%.

Study Period: It is recommended that candidates dedicate 100 hours or more to prepare for the exam. For those without a finance background, a study period of 130 hours or more is recommended to ensure thorough understanding of the material.

Preparing for the Exam

Given the comprehensive nature of the exam, thorough preparation is essential for success. Here are some key steps to help you prepare effectively:

1. Understand the Exam Content: Familiarize yourself with the specific topics and areas that will be covered in the exam. This includes gaining a deep understanding of ESG factors and their relevance to investment decision-making.

2. Utilize Study Materials: Take advantage of study materials provided by CFA Institute, as well as reputable third-party resources. These may include textbooks, practice questions, online courses, and study guides.

3. Create a Study Plan: Develop a structured study plan that allocates sufficient time to cover all relevant topics. Be sure to balance your study time across environmental, social, and governance factors to ensure comprehensive preparation.

4. Practice Regularly: Regular practice is essential for reinforcing your understanding of ESG concepts and familiarizing yourself with the exam format. Consider taking practice exams under timed conditions to simulate the actual testing environment.

5. Seek Support: If you encounter challenging concepts or topics during your preparation, don't hesitate to seek support from mentors, tutors, or study groups. Engaging with others can provide valuable insights and help clarify any areas of confusion.

6. Stay Updated: Given the evolving nature of ESG considerations in the investment landscape, stay updated on industry developments and best practices. This may involve reading industry publications, attending webinars, or participating in relevant discussions.

By following these steps and dedicating ample time to preparation, you can enhance your readiness for the CFA ESG exam and increase your chances of success.

Test Your Readiness with SPOTO's Free Exam Prep Check!

Key Considerations

As you embark on your journey to prepare for the CFA ESG exam, it's important to keep several key considerations in mind:

1. Time Management: With a duration of 2 hours and 20 minutes for 100 questions, effective time management is crucial. Practice pacing yourself during your study sessions to ensure that you can answer questions within the allocated time during the exam.

2. Conceptual Understanding: The exam is designed to assess not only your knowledge of ESG principles but also your ability to apply them in practical scenarios. Focus on developing a strong conceptual understanding of ESG factors and their implications for investment decision-making.

3. Ethical Considerations: ESG investing is closely tied to ethical considerations and responsible investment practices. Be prepared to demonstrate an awareness of ethical principles and their application within the context of ESG investing.

4. Real-World Application: As you study ESG concepts, strive to connect them to real-world examples and case studies. This will help you contextualize your learning and understand how ESG considerations are integrated into investment analysis and decision-making processes.

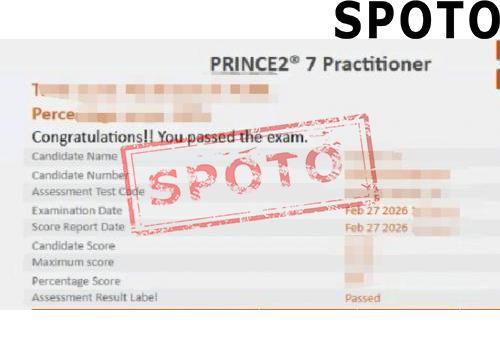

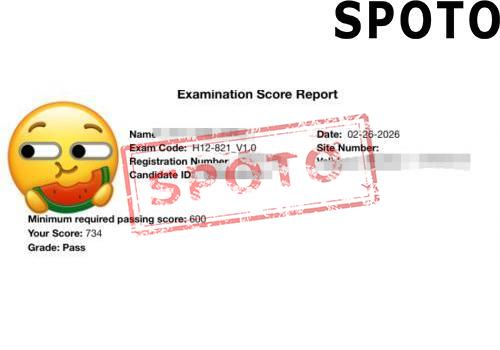

SPOTO Exam Service: Your Path to Success

If you find yourself short on time to adequately prepare for your upcoming exam, consider utilizing SPOTO's CFA ESG exam service. With a 100% passing rate and dedicated customer service, we're committed to helping you achieve your goals effortlessly.

We understand the challenges of exam preparation and offer a comprehensive solution that guarantees success and handles all distractions. Our expert team assists you from registration to exam scheduling, so you can focus on mastering the exam material.

Experience a stress-free exam journey with our latest study materials and expert support. Our team is available around the clock for any questions and guidance, ensuring a smooth preparation process.

Choose SPOTO Exam Service as your committed partner for success. With our proven track record and satisfied customers, we're equipped to support your certification goals, no matter the exam.

Don't let exam preparation hinder your career ambitions. Let SPOTO Exam Service handle the details so you can focus on achieving your goals confidently. Contact us today to start your certification journey with the support you need.