Table of Contents

- 1. What is an Risk Management Specialist?

- 2. What does an Risk Management Specialist do?

- 3. How much does an Risk Management Specialist Make?

- 4. Job Outlook of Risk Management Specialist

- 5. Similar Occupations of Risk Management Specialist

- 6. What Are the Qualifications to Become an Risk Management Specialist?

1. What is an Risk Management Specialist?

Risk management experts are responsible for detecting, identifying, and analyzing potential risks that may affect the financial stability, reputation, or operations of an organization, and taking necessary measures to intervene and eliminate these risks to ensure the safety and stability of the enterprise's operations. These risks cover a wide range of areas, including financial risks, operational risks, regulatory compliance, cybersecurity threats, natural disasters, and more.

2. What does an Risk Management Specialist do?

Risk management experts are mainly responsible for helping companies identify, evaluate and control risks that may have an adverse impact on business operations, financial status or reputation. First, they need to make reasonable use of risk models, data analysis and market trend research to predict the probability of potential risks and their impact. Then, based on these analysis results, risk management experts will develop specific risk response strategies, such as implementing risk control measures, purchasing insurance, or establishing emergency plans. At the same time, they will also work closely with finance, legal affairs, operations and other departments to ensure that risk management strategies can be integrated into the overall business process and comply with corporate policies and regulatory requirements. In addition, risk management experts need to regularly monitor risk status, adjust strategies according to changes in the external environment or internal needs, and report risk status and response results to senior management. Their work is crucial for companies to reduce losses, improve stability and ensure long-term development.

3. How much does an Risk Management Specialist Make?

According to ZipRecruiter, the average annual salary for a Risk Management Specialist in California is $71,972 as of June 10, 2026. That works out to about $34.60 per hour. That works out to $1,384 per week or $5,997 per month. Salaries range from as high as $136,687 to as low as $37,009, but most Risk Management Specialists currently make between $49,300 and $83,400, with top earners making $127,804 per year in California. The average pay range for a Risk Management Specialist varies greatly (as much as $34,100), which suggests there may be many opportunities for advancement and increased pay based on skill level, location, and years of experience.

4. Job Outlook of Risk Management Specialist

As companies' need to manage and mitigate potential risks increases, the market demand for risk management experts is rising. According to data from the careerexplorer website, there are currently about 136,000 risk management experts in the United States. It is expected that the job market for risk management experts will grow by 6.0% between 2022 and 2032.

5. Similar Occupations of Risk Management Specialist

- Risk Analyst

- Compliance Analyst

- Operational Risk Analyst

- Risk Manager

- Director of Risk Management

- Chief Risk Officer (CRO)

- Credit Risk Analyst

- Market Risk Analyst

- Compliance Officer

- Risk Consultant

6. What Are the Qualifications to Become an Risk Management Specialist?

(1) Obtain a Bachelor's Degree

The necessary education level is the first step to start a career. The work content of Risk Management Specialist mainly revolves around risk analysis in the business environment. A degree in finance, business administration, accounting or related fields is likely to be favored by employers.

(2) Develop professional skills

As a risk professional, continuous skill development is essential to advance your career and stay competitive in the evolving field of risk management. Here are the key skills to consider in becoming a risk management expert: First, it is essential to have a solid foundation in risk management principles, methods, and tools. This includes understanding the various types of risks, such as operational, financial, strategic, and compliance risks, as well as risk assessment and mitigation techniques. Continuous learning through IRM’s professional certifications, seminars, and industry conferences can help you stay up to date on the latest best practices, regulatory changes, and emerging technologies relevant to your field. Second, risk professionals need to be adept at analyzing massive amounts of data to identify patterns, trends, and potential risks. Mastering data analysis tools, statistical modeling, and data visualization skills can significantly enhance your ability to make informed decisions and provide valuable insights to stakeholders. This may include learning programming languages such as “Python” or “R” and applying data analysis software and tools. Finally, effective communication is essential for risk management professionals to be able to convey complex concepts, findings, and recommendations to a variety of stakeholders, including senior management, clients, and regulators. Developing written and verbal communication, presentation and negotiation skills can significantly enhance your ability to influence decisions, gain buy-in for risk management strategies and build strong relationships with stakeholders. Why not join IRM to develop these skills? Browse our training programs to learn more.

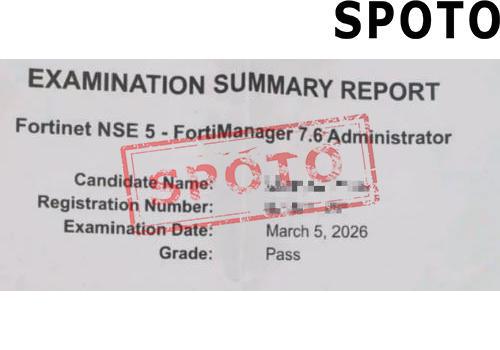

(3) Earn Industry Certifications

Obtaining a certification that is highly recognized by the industry can prove your professional ability and ability to perform the position, and can also enhance your competitiveness in the workplace. Therefore, we recommend that you obtain the Cisco Advanced Security Architecture for Enterprise Architecture Management certification.Cisco 700-760 ASAEAM (Advanced Security Architecture for Enterprise Architecture Management) is one of Cisco's certification exams, focusing on advanced security architecture and enterprise architecture management. People who obtain this certification usually have in-depth knowledge in network security and enterprise architecture, and can play an important role in designing, implementing, maintaining and optimizing enterprise-level network security architecture.