Table of Contents

As a renowned global financial hub, Singapore has witnessed rapid development in the field of Environmental, Social, and Governance (ESG) investing in recent years, gradually emerging as a vital hub for ESG investment in Asia. The following is an overview of the current state and significance of ESG investment in Singapore:

Policy Support and Incentive Mechanisms

In February 2021, the Singapore government launched the "Singapore Green Plan 2030," aimed at providing financial assistance to support companies in pursuing sustainable development. Furthermore, Singapore's sustainable information disclosure policy is relatively more inclined towards incentive-based regulations, in contrast to the more mandatory approaches seen in Europe and the US, to avoid alienating investors and companies.

Market Development and Investment Trends

The Singapore Exchange (SGX) encourages companies to adopt the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD), and continues to update its reporting guidelines, although corporate adoption remains voluntary. Singapore is also the largest green finance market in ASEAN and a preferred listing destination for corporate ESG bonds in the Asia-Pacific region.

Growth and Potential of ESG Investments

ESG investing has become a global trend in the investment industry and wealth management sector, and as a financial hub, Singapore is enhancing its competitiveness in ESG investments through policy measures. The market size of ESG investments is expected to grow exponentially, particularly in the context of achieving global climate change mitigation goals.

Regulatory Framework and Information Disclosure

The Monetary Authority of Singapore (MAS) is responsible for formulating ESG regulatory policies. While there is currently a lack of an independent regulatory body to oversee corporate sustainability information disclosure, the Singapore authorities still have a long way to go in pushing companies to disclose in line with international reporting standards.

Corporate and Investor Engagement

Singapore's companies are gradually recognizing the link between sustainability and performance, and are beginning to prioritize ESG information disclosure. At the same time, investors are increasingly focused on corporate ESG performance, making it a critical factor in their investment decisions.

Education and Training

The Government of Singapore Investment Corporation (GIC) and Temasek have announced the launch of ESG investment and sustainable finance certification programs at their Wealth Management Institute, to build a talent pool for Singapore's ESG investment landscape.

Challenges and Opportunities

While Singapore's ESG investment journey has been relatively slow, the relevant authorities are expected to engage more proactively with market participants and stakeholders to refine the regulations around sustainable information disclosure.

In summary, Singapore has exhibited a clear sense of positivity and development potential in the realm of ESG investing. The government's policy support, the market's enthusiastic response, and the recognition of future opportunities all indicate that Singapore is gradually becoming a crucial hub for ESG investment in Asia and globally. As global attention on sustainable development continues to grow, the significance of Singapore's role in the ESG investment landscape will further strengthen.

With the rapid development of Environmental, Social, and Governance (ESG) investing in Singapore, it is evident that the country is emerging as a vital hub for ESG investment in Asia. Among the numerous ESG certifications available, the CFA ESG Certification holds significant importance in this landscape.

What is the CFA ESG Certification?

The CFA ESG certification is a professional credential that demonstrates the holder's expertise in not only traditional financial analysis, but also in-depth knowledge of ESG (Environmental, Social, and Governance) investing. This certification covers multiple aspects of ESG investing, including but not limited to:

- Environmental: Considerations around a company's impact on the natural environment, such as climate change, resource usage, pollution control, and green technology.

- Social: Focuses on a company's relationships with employees, suppliers, customers, and the surrounding community, including labor standards, consumer protection, community engagement, and respect for human rights.

- Governance: Pertains to a company's governance structure and processes, such as board diversity, compensation policies, internal controls, and shareholder rights.

Key Areas Covered by the CFA ESG Certification:

- ESG Integration: Systematically integrating ESG factors into the investment analysis and decision-making process.

- Risk Management: Assessing and managing the impact of ESG-related risks on investment portfolios.

- Investment Products and Strategies: Understanding and applying various ESG investment products and strategies, such as negative screening, positive screening, and impact investing.

- Corporate Engagement and Stewardship: Actively engaging with companies to drive improvements in their ESG performance.

- ESG Reporting and Disclosure: Comprehending ESG reporting frameworks and standards, such as the Global Reporting Initiative (GRI) and the Sustainability Accounting Standards Board (SASB).

The CFA ESG certification not only benefits individual career development but also provides a way for organizations to identify and attract talent with specialized ESG knowledge. As Singapore and global markets continue to place greater emphasis on ESG, the value and relevance of the CFA ESG certification will continue to grow.

CFA ESG Exam Overview

Exam Format: The exam can be taken online or at a test center, providing flexibility for candidates to choose the most convenient option for them.

Exam Duration: The exam has a total duration of 2 hours and 20 minutes.

Question Type: There are 100 single-selection questions, each with three choices.

Passing Score: Candidates are required to achieve a 60%-70% accuracy rate to pass the exam.

Average Pass Rate: The average pass rate for the CFA ESG exam is approximately 81%.

Study Period: It is recommended that candidates dedicate 100 hours or more to prepare for the exam. For those without a finance background, a study period of 130 hours or more is recommended to ensure thorough understanding of the material.

The Difficulty of the CFA ESG Exam

For many professionals considering taking this exam, an inevitable question is: How difficult is the CFA ESG exam? We will delve into multiple aspects of the CFA ESG exam to provide a comprehensive perspective and help potential candidates better assess the challenges of the CFA ESG exam.

Difficulty of Exam Content

The CFA ESG exam covers a wide range of topics related to ESG investing, including but not limited to ESG integration, risk management, investment products and strategies, corporate engagement and stewardship, and ESG reporting and disclosure. The exam consists of 100 multiple-choice questions, which candidates must complete within 2 hours and 20 minutes, presenting a significant challenge in itself.

Challenges in Exam Preparation

Preparing for the CFA ESG exam requires a substantial investment of time and effort. According to official recommendations, candidates should allocate approximately 100 hours of study time. For those already involved in the ESG field or with relevant background, this may be a process of review and consolidation. However, for ESG newcomers, they may need to spend more time building a solid knowledge foundation.

Adapting to Exam Format

The CFA ESG exam is conducted entirely in English, using a multiple-choice question format. This can pose an additional challenge for non-native English speakers, who need to possess strong reading comprehension and English language skills to accurately grasp the questions and make the right choices.

Impact of Personal Background

A candidate's personal background significantly influences their perception of the exam's difficulty. Those with a financial, economic, or related academic background may find the exam content more relatable to their previous learning experiences, while those from completely different disciplines may need to exert additional effort to understand the specialized terminology and concepts.

In summary, the perceived difficulty of the CFA ESG exam is subjective and influenced by various factors. While the exam content is comprehensive and presents certain challenges, candidates can overcome these obstacles through thorough preparation and strategic learning. The key lies in investing the necessary study time, utilizing the official study materials and practice questions, and potentially joining a study group or attending a prep course, if possible.

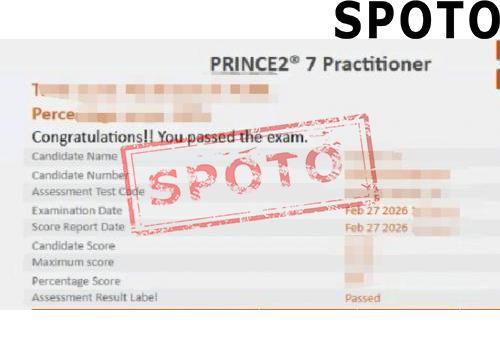

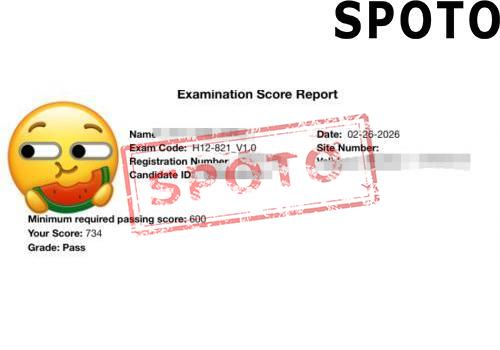

Get Your CFA ESG Certification with SPOTO!

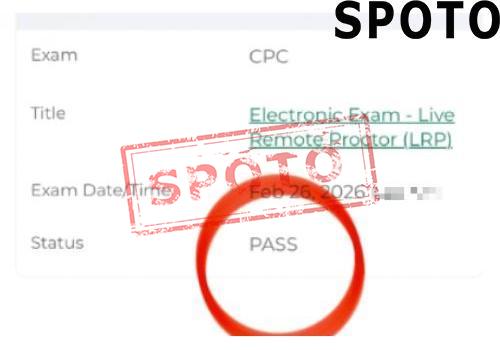

For busy candidates, preparing for the CFA ESG exam is no easy task, as it requires a significant investment of time and effort. This is the motivation behind SPOTO's launch of the CFA ESG exam proxy service. We understand that not everyone has the ample time and effort to complete the lengthy preparation process, and therefore we provide a safe and reliable solution for these busy professionals.

SPOTO's CFA ESG exam proxy service offers the following key advantages:

- Pass Exam Rate Guarantee: We only assign experienced and high-performing professional proxies to ensure you easily pass the exam and obtain the long-awaited CFA ESG certification.

- Secure and Reliable Service: We employ strict identity verification and monitoring measures to ensure the entire exam process is compliant, eliminating any possibility of misconduct. You can rest assured that we will prioritize protecting your interests.

- Highly Confidential Process: We strictly maintain the confidentiality of all client information, ensuring your privacy and data security. This is a bottom-line requirement for us.

- Convenient and Efficient Experience: Simply contact us, and we will arrange for a professional proxy to complete the exam at the designated time. The entire process is quick and efficient, allowing you to easily obtain the CFA ESG certification.

As a leading provider of CFA ESG exam proxy services, SPOTO has helped numerous finance professionals achieve their dreams over the years, earning widespread recognition and positive reviews. If you also want to easily obtain the CFA ESG certification but struggle to allocate sufficient time for thorough preparation, feel free to contact us, and we will make every effort to ensure you successfully pass the exam.