Table of Contents

Ⅰ. An Introduction to ESG Certification

In the contemporary business landscape, companies are increasingly recognizing the importance of adopting sustainable practices that go beyond mere profit margins. Environmental, Social, and Governance (ESG) criteria have emerged as key metrics to measure a company's commitment to responsible business practices. To navigate this evolving landscape, businesses are turning to ESG certification to showcase their dedication to sustainability. Let's delve into the three key aspects of ESG certification.

1. The Background of ESG Certification

The roots of ESG certification can be traced back to the growing global awareness of the impact businesses have on the planet and society. As stakeholders—ranging from investors and customers to employees—demand greater transparency and responsibility, companies are compelled to integrate sustainability into their core values. ESG certification serves as a structured framework, allowing organizations to evaluate and communicate their performance in key areas: environmental stewardship, social responsibility, and governance practices.

2. What is ESG Certification?

ESG certification is a formalized process through which companies undergo evaluation based on predefined ESG criteria. These criteria cover a broad spectrum, encompassing environmental sustainability, social impact, and governance practices. Companies are assessed on various parameters, including carbon footprint, diversity and inclusion, labor practices, ethical leadership, and board effectiveness. Independent third-party organizations or specialized agencies typically conduct the assessments, ensuring objectivity and credibility in the certification process.

3. The Benefits of ESG Certification

a. Attracting Responsible Investors

ESG-certified companies often find themselves more attractive to investors who prioritize sustainable and ethical investments. As the financial world increasingly recognizes the material impact of ESG factors on long-term business success, investors are seeking opportunities with companies committed to positive environmental and social outcomes.

b. Enhancing Brand Reputation

Consumers today are more conscious than ever about the ethical practices of the brands they support. ESG certification provides a visible and credible stamp of approval, helping companies build trust with customers and differentiate themselves in a crowded market. A positive reputation for social and environmental responsibility can lead to increased customer loyalty and preference.

c. Mitigating Risks and Improving Operational Efficiency

Through the ESG certification process, companies gain valuable insights into potential risks associated with their environmental and social practices. Addressing these risks not only aligns with sustainable goals but also fosters operational efficiency. By proactively managing ESG factors, organizations can minimize legal, reputational, and operational risks, ultimately contributing to long-term resilience.

Ⅱ. The Bright Horizon of ESG Certification

ESG (Environmental, Social, and Governance) certification has rapidly emerged as a catalyst for reshaping the investment landscape. Embedded within the broader paradigm of ESG investing, this approach to asset management goes beyond traditional financial metrics to encompass a holistic evaluation of a company's impact on the environment, society, and corporate governance. As the financial sector undergoes a paradigm shift towards sustainability, the prospects of ESG certification are not only promising but also transformative.

1. Holistic Investment Approach

ESG investing represents a departure from conventional investment practices that primarily focus on financial indicators. By explicitly incorporating environmental, social, and governance factors into investment decisions, ESG certification introduces a holistic approach. This comprehensive evaluation enables investors to gain a nuanced understanding of a company's sustainability practices, risk management, and long-term resilience, contributing to a more informed investment strategy.

2. Mitigating Risks and Enhancing Returns

Traditional investments often fail to consider the broader impact a company has on the environment and society. In contrast, ESG-certified investments are designed to identify and mitigate non-financial risks that can significantly influence a company's future performance. This proactive risk management not only safeguards investments against unforeseen challenges but also positions portfolios for long-term success. By accounting for ESG factors, investors aim to achieve a delicate balance: reducing risks while simultaneously enhancing the overall return on investment.

3. Aligning with Sustainable Goals

As the global community intensifies its focus on sustainable development, ESG certification provides investors with a practical way to align their portfolios with environmental, social, and governance considerations. By selecting investments based on these principles, investors contribute to the broader goals of promoting responsible business practices, reducing carbon footprints, and fostering positive social impacts. This alignment not only satisfies the growing demand for ethical investments but also positions ESG-certified portfolios as integral players in driving positive change.

4. Meeting Investor Demand

The increasing popularity of ESG investing underscores a significant shift in investor preferences. Modern investors are not only seeking financial returns but also value-driven opportunities that align with their ethical and sustainable aspirations. ESG certification serves as a beacon for such investors, providing a clear signal that a company is committed to responsible practices. As more investors recognize the potential for aligning their values with their investments, the demand for ESG-certified assets is poised for substantial growth.

Ⅲ. Why ESG Certification is Essential

In a world where the need for sustainable practices is more critical than ever, businesses are finding new ways to align with global goals. One powerful step towards a sustainable future is obtaining ESG (Environmental, Social, and Governance) certification. With estimates by the International Energy Agency projecting the creation of millions of jobs in clean energy and energy-saving initiatives by 2030, the imperative to get ESG certified has never been more compelling.

1. Tapping into the Green Workforce

The transition to a sustainable economy is expected to generate an estimated 14 million clean energy investment jobs by 2030, according to the International Energy Agency. By obtaining ESG certification, companies position themselves as contributors to this green workforce revolution. ESG-certified businesses signal to prospective employees that they are committed to environmental sustainability, attracting talent that is not only skilled but also passionate about making a positive impact.

2. Leading in Energy Efficiency

The projection of 16 million jobs in building energy-saving renovation and new energy vehicle investment underscores the growing importance of energy-efficient practices. ESG certification acts as a strategic tool for companies to showcase their commitment to energy efficiency and sustainable development. By implementing measures that align with ESG criteria, businesses not only contribute to global energy-saving initiatives but also position themselves as leaders in a sector poised for significant growth.

3. Accessing Green Investment Opportunities

ESG-certified companies are more likely to attract investment from funds and investors with a focus on sustainability. As the investment landscape shifts towards ESG considerations, businesses that undergo ESG certification demonstrate their readiness to embrace green opportunities. This not only opens doors to capital but also enhances the company's financial resilience, as ESG investments are increasingly recognized for their potential to deliver robust long-term returns.

4. Enhancing Brand Value and Market Position

Consumers are becoming more discerning, seeking products and services from companies that align with their values. ESG certification provides a credible and transparent way for businesses to communicate their commitment to environmental and social responsibility. This, in turn, enhances brand value and market position, fostering customer loyalty and trust. ESG-certified companies are better positioned to capture a share of the growing market of environmentally conscious consumers.

Ⅳ. Understanding the Challenges of ESG Certification

Embracing Environmental, Social, and Governance (ESG) certification is a commendable commitment towards responsible business practices. However, it's essential to acknowledge that the journey toward certification can be a complex and challenging process. Here, we explore some of the difficulties associated with ESG certification.

1. Data Collection and Verification

One of the primary challenges lies in collecting accurate and comprehensive data related to a company's environmental, social, and governance practices. This process involves collating information from various departments, ensuring data consistency, and undergoing rigorous verification. Companies often find it challenging to establish transparent and reliable systems for data tracking and reporting.

2. Standardization and Measurement Metrics

ESG certification involves adherence to specific standards and frameworks, but the lack of universal guidelines can create ambiguity. Different industries may have unique ESG considerations, making it challenging for companies to determine the most relevant metrics. The absence of standardized measurement metrics can complicate the assessment process and make benchmarking against industry peers more difficult.

3. Integration into Corporate Strategy

Embedding ESG principles into the core of corporate strategy requires a substantial shift in mindset and practices. Companies must go beyond token gestures and implement substantive changes to their business operations. Aligning ESG considerations with long-term business goals demands strategic planning and a commitment to cultural change, which can be challenging to achieve.

4. Stakeholder Engagement

Engaging stakeholders, including employees, suppliers, and local communities, is a crucial aspect of ESG certification. Gaining support and cooperation from various parties requires effective communication and collaboration. Managing diverse expectations and ensuring that stakeholders are actively involved in sustainable initiatives can be a time-consuming and intricate process.

5. Costs and Resource Allocation

ESG certification often necessitates investments in technology, personnel training, and sustainability initiatives. Allocating resources to meet certification requirements can be a financial challenge for some companies, especially smaller enterprises with limited budgets. Striking a balance between achieving certification goals and managing costs is a delicate undertaking.

6. Continuous Improvement

ESG certification is not a one-time achievement but an ongoing commitment to improvement. Companies must continuously assess, adapt, and enhance their practices to meet evolving standards and expectations. Maintaining a culture of continuous improvement requires a sustained effort and the willingness to embrace change at all organizational levels.

Ⅴ. SPOTO: Your Trusted Partner on the Road to ESG Certification Success

Embarking on the journey to ESG certification is a formidable challenge, encompassing a broad spectrum of knowledge and expertise. Choosing the right training institution is pivotal in ensuring a smooth and successful certification process. In this pursuit, SPOTO emerges as an excellent choice, bringing decades of training experience, expert industry instructors, and cutting-edge exam resources to the table.

Why SPOTO Stands Out:

1. Decades of Training Excellence

SPOTO boasts an extensive and reputable history in the field of professional training. With years of experience, SPOTO has honed its methodologies to cater specifically to the diverse and demanding requirements of ESG certification candidates.

2. Professional Industry Instructors

At the heart of SPOTO's success lies its team of seasoned industry instructors. These professionals bring not only theoretical knowledge but also practical insights into the intricacies of ESG certification. Their expertise ensures that candidates receive top-tier guidance throughout their training journey.

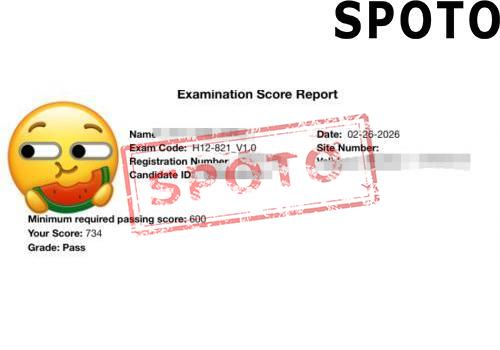

3. Latest Exam Dumps for Comprehensive Coverage

SPOTO's exam dumps are crafted with precision, offering an unparalleled advantage to candidates. The dumps provide comprehensive coverage, addressing 100% of the exam points without unnecessary bulk. This focused approach ensures that candidates can efficiently direct their efforts towards mastering essential content.

4. Accuracy in Content

Accuracy is the cornerstone of SPOTO's exam dumps. Unlike other institutions, SPOTO prioritizes quality over quantity, delivering precise and relevant content. This commitment to accuracy enhances the effectiveness of the training materials, allowing candidates to focus on the core concepts essential for ESG certification success.

5. Timeliness in Updates

ESG certification landscapes evolve, requiring candidates to stay abreast of the latest developments. SPOTO addresses this need by ensuring timely updates to its dump test questions. Candidates can trust that they are equipped with the most current and relevant information, eliminating concerns about missing crucial test points.

6. Personalized and Professional Training

SPOTO goes beyond generic training approaches, offering one-on-one sessions with professional instructors. This personalized training ensures that candidates can master each test point thoroughly. The result is an increased confidence level and a guarantee of a 100% exam passing rate.

Ready to Achieve ESG Certification Success? Elevate your chances of success by choosing SPOTO—your trusted partner in mastering the intricacies of ESG certification. Join us today and stride confidently towards a sustainable and certified future!