Cisco Systems: Why Software Conversion Will Significantly Raise Valuation

Summary

Cisco began its most considerable strategy reorientation to date in 2017. The business plans to switch its focus from hardware to Software as a subscription.

The effect of this strategy change is being understated, in my opinion. As evidenced by earlier cases, such a change can significantly increase shareholder value.

The "double effect" of switching to Software as a subscription is that Cisco's multiple and sales should increase dramatically. As a result, I anticipate 42% growth over the next three years.

The "old" hardware corporation Cisco Systems is regarded by many as having little room for expansion. When considering prior performance, this is true. However, the business is undergoing a significant transformation. Importantly, Chuck Robbins, who was named CEO in 2015, created a great plan to implement a transition from a "dying" hardware company to a "fresh" IT service provider with a software focus.

I'll make two contributions to this essay. I'll start by giving details regarding this strategy shift toward Software. What role does it play in Cisco's business strategy, and how quickly are software sales increasing? I'll demonstrate why this conversion will significantly increase shareholder value. Numerous historical instances show how the market considerably boosts revenues and multiples for businesses switching to a software-as-a-service model ("SaaS"). Based on this software expansion, I predict a 43% increase for Cisco over the next three years.

The Software as a Service (SaaS) approach of Cisco

the explosion of Software as a subscription

Software as a subscription, which benefits both the consumer and the provider, has experienced a significant shift in IT during the past ten years. The customer receives an easy-to-use software platform for all employees that is regularly updated without paying a high entry cost. Recurring payments will be delivered to the supplier, reducing the volatility of revenues and increasing monetization per customer. Due to these benefits, Microsoft is famous among numerous renowned businesses.

The software approach of Cisco

Unlike software companies, Cisco was a pure hardware company, which made changing its business model much more difficult. Cisco primarily sold (and still sells) routers and switches to connect electronic devices without considering Software. While Software can offer recurring earnings that are much more intriguing, hardware installation projects are particularly vulnerable to economic downturns. CEO Robbins decided to radically revamp Cisco after realizing the enormous potential in Software. The business began concentrating on Software by making numerous acquisitions and luring top employees.

The 2017 release of the Cisco One software makes it quite obvious how the software subscription cost replaces the money made from selling the hardware. This new approach should be pretty profitable in the long run because the membership cost results in much higher monetization per consumer. Given that Cisco is currently lowering device pricing and offering specific software discounts to win over new clients, this could have a short-term negative effect on sales.

Along with the transition from hardware to Software, there is a movement in the monetization and recurring revenue model from the perpetual approach (entry charge and maintenance fee) to subscription (just subscription fees). Subscription clients now make almost 70% of software sales, a significant increase as of Q4 2019.

Example of Software: DNA

Cisco has introduced numerous cloud, business networks, security, and data analytics software solutions. It is crucial to comprehend the functionality of various software packages, so I will quickly discuss one of them, Digital Network Architecture ("DNA"). DNA is a device that offers a graphical and programming interface for designing, managing, and adding widgets to your network. Cisco now provides Software as a subscription that gives the corporation graphical interfaces for network faults, comments on how the company should handle complex network scenarios and sells hardware that enables networking. To put it briefly, DNA can be considered an enterprise network management platform.

Examples of past SaaS conversion

Interestingly, many businesses that started offering Software as a subscription saw significant long-term gains in revenues, earnings, and stock prices. This section will provide examples of pure software companies that leaped SaaS. I will project Cisco's stock performance in the future using these historical instances.

Examples of SaaS conversions

Adobe Systems announced its creative subscription-only business model in May 2012, marking a significant shift in its approach. Before 2012, it offered Software on CDs for sale, assuming one-time fees. Following that, it started receiving monthly subscription payments, which ultimately resulted in tremendous growth. It is significant to note that the switch from non-recurring to recurring revenues (or "NRR" and "ARR") does not have an immediate beneficial effect on revenues. In reality, only 2.5 years after the launch of the subscription, payments started to increase dramatically.

As you can see, profits increased rapidly over time. Adobe consistently reports revenue growth of 20% or more with expanding margins. It's interesting to note that the market did value the strategic shift because, with the introduction of the software subscription, the stock price has since climbed by 754%.

Conclusion

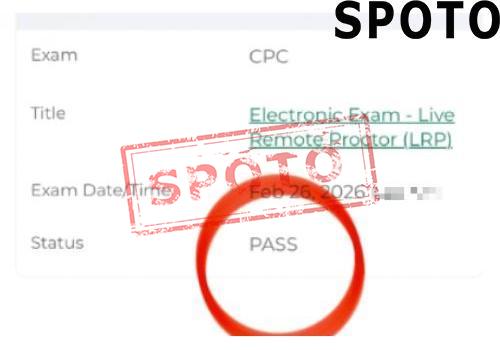

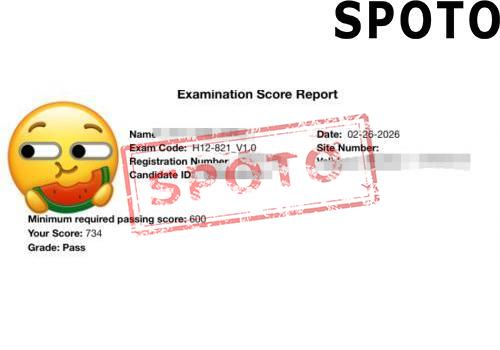

You can seek assistance from SPOTO if you want to fully prepare for the Cisco and strengthen your competitive edge in the IT sector. SPOTO offers helpful online courses that can help you prepare for your certification. Kindly click it!